-

play_arrow

play_arrow

BayRadio Listen Live Broadcasting in Spain

Are your current Wealth Management and Pension plans fit for purpose?

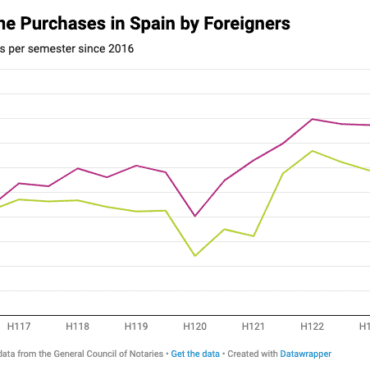

With the current CV19 crisis and Brexit looming it has never been more important for UK Expatriates and those who are considering moving to Spain to ensure that their wealth is invested in the right places and products.

We have seen the impact that the “lockdowns” have had on world economies and the financial markets over the last 6 months. Whilst markets have stabilised, autumn is approaching and CV19 infections will rise again, regional lockdowns in countries will occur with more regularity and tighter restrictions on movement within countries and between countries will/could be put in place.

All countries around the world are looking at raising taxes to pay for the costs of the “pandemic” and they have workers, pensioners, savers and investors in their sight. They are looking at various options to fill this black hole of debt. Various ways to do this have been mooted; including but not exclusively limited to; increasing inheritance tax rates above the tax free threshold, increasing capital gains tax , scrapping the triple lock on UK state pensions, taxing investments, scrapping the 25% tax free lump sum on pensions.

On top of this the UK has Brexit looming, if it exits with a “no deal” , as now seems likely , sterling will weaken even further, impacting the value of UK Expats sterling denominated pension even more, decreasing their buying power and possibly negatively impacting their standard of living.

In addition, Brexit could mean for investors located outside the UK, access to UK based investments and products will be limited or impossible unless you have taken the right advice and restructured your investment and pension portfolios. Many UK based financial advisers have stopped offering their services to non UK based individuals and many small financial advice companies are finding the current economic climate challenging and are either closing down, cutting back or merging with larger companies that are well established and have the financial means to continue through volatile times.

Blacktower have been advising clients for over 30 years now, through both the good and bad times, and our role is to utilise that experience in dealing with different types of market conditions, to make sense of the current situation and to be there to reassure clients.

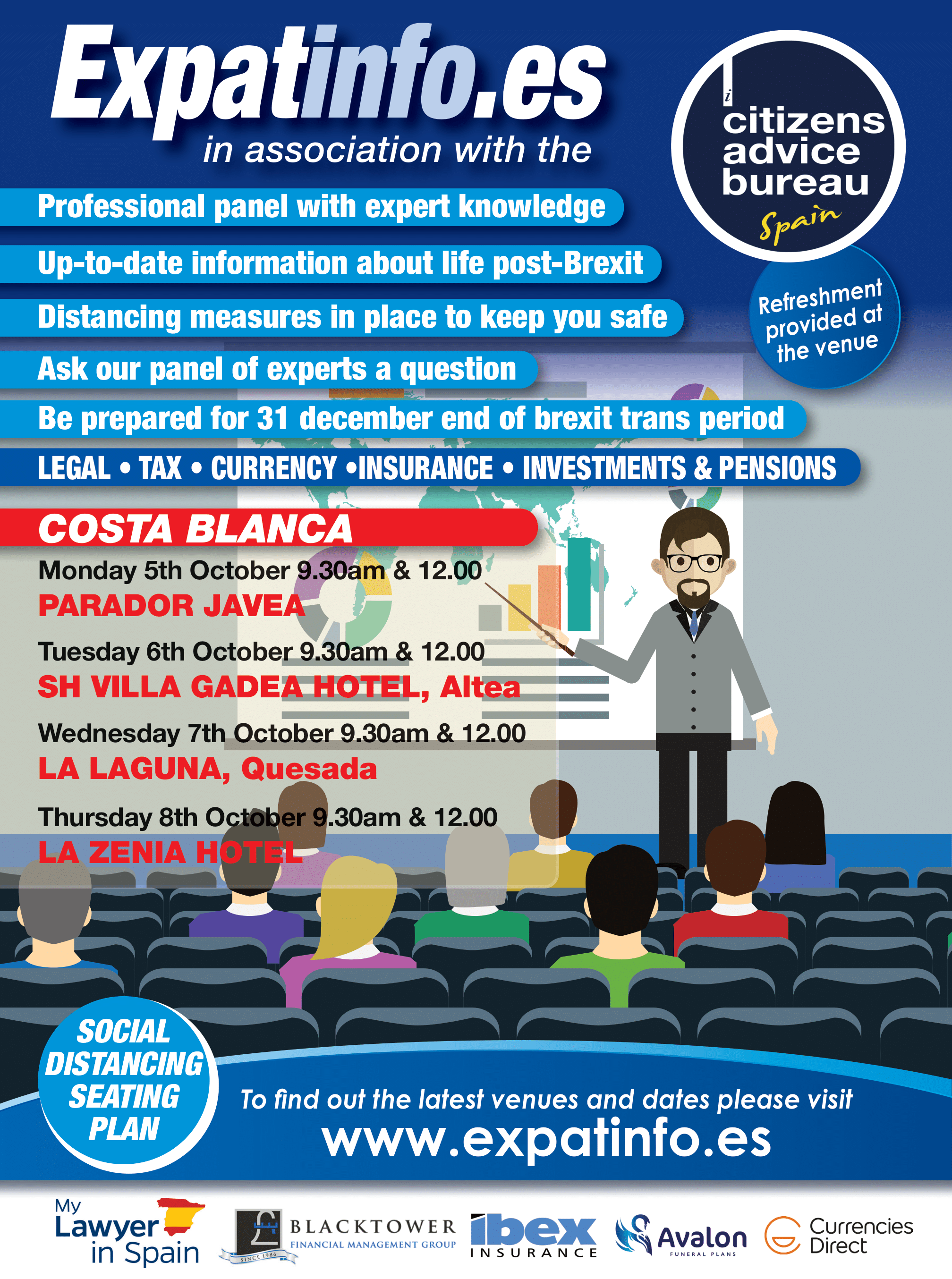

If you would like to meet with an expert, Blacktower Financial Management have been invited to take part in the Expatinfo Brexit Seminars that will take place throughout the Costa Blanca during the first week of October. Javea 5th October, Altea 6th October, Quesada 7th October , La Zenia 8th October , for full details and to register your place go to www.expatinfo.es.

Blacktower will be by your side both now and in the future, we are here to help you weather the stormy waters ahead. To arrange a professional and impartial consultation please contact me by email [email protected] or call me on mob: 658 892 330, office: 965 058 212. Website: www.blacktowerfm.com/locations/spain-costa-blanca

The above information was correct at the time of preparation and does not constitute investment advice and you should seek advice from a professional adviser before embarking on any financial planning activity.

Blacktower Financial Management Ltd is authorised and regulated in the UK by the Financial Conduct Authority and is registered with both the DGS and CNMV. Blacktower Financial Management (Int) Ltd is licensed in Gibraltar by the Financial Services Commission (FSC) and is registered with both the DGS and CNMV in Spain.

Written by: BayRadio News

Similar posts

Recent Posts

- Robotic Surgery for Prostate Cancer: What Is Radical Prostatectomy and How Does the Da Vinci Robot Improve It

- What Is Fibromyalgia? Symptoms and Treatments of an Invisible Illness That Requires Specialized Attention

- AMASVISTA Glass: 10 reasons to choose SUNFLEX glass curtains

- Robotic Surgery, Immunotherapy and Comprehensive Care Take Centre Stage at Pancreatic Cancer Conference at Quirónsalud Torrevieja

- Robotic Surgery Against Ovarian Cancer: Greater Precision, Less Pain and Faster Recovery

Ctra. Cabo La Nao, CC La Nao, Local 6 03730 Javea, Alicante, Spain

Advertise with us

Do you have a business in Spain? Do you provide a service to the expat community in Spain? Would you like your message to reach over 500.000 people on a weekly basis?

BayRadio is a community orientated radio station offering fantastic content to our many listeners and followers across our various platforms. Contact us now and find out what Bay can do for you!

Our business is helping your business grow.

BAY RADIO S.L. © 2024. ALL RIGHTS RESERVED. WEB DESIGN BY MEDIANIC