-

play_arrow

play_arrow

BayRadio Listen Live Broadcasting in Spain

OCU advises those with savings in the bank: “The interest rate is rising”

On 8 September, the European Central Bank (ECB) raised interest rates to 1.25% for the second consecutive time in two months. Today, President Christine Lagarde announced new increases to address runaway inflation.

“In the medium term we have to push inflation back to 2% and we will do what we have to do. That is to say keep raising the interest in the next meetings”, she explained.

Lagarde has also confirmed that due to the economic shock of the Russian invasion in Ukraine and the ensuing price crisis, the outlook for the eurozone economy is for activity to slow “substantially” in the coming quarters. “Our goal is not to reduce growth, our essential goal is to ensure price stability. That is something the ECB has to achieve,” he added.

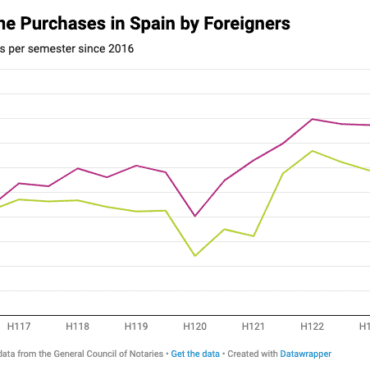

When interest rates rise, the price of loans also increases. Therefore, those who have contracted a variable rate mortgage will be the main ones affected, however consumers who have their savings in the bank will benefit from interest rate hikes.

As explained by the Consumers and Users Organization (OCU) “if you have saved funds that you do not need immediately, but which you do not want to risk, a good deposit can be a solution”.

The organization warns: “However, the profitability of these investments is limited, so deposits are really a good option to invest at a short-term horizon without taking any risks. However, if you have money that you will not need in the next 5 or 10 years, you can get more out of it and get higher returns by following an investment strategy appropriate to your expectations.”

Written by: BayRadio News

Similar posts

Recent Posts

- Robotic Surgery for Prostate Cancer: What Is Radical Prostatectomy and How Does the Da Vinci Robot Improve It

- What Is Fibromyalgia? Symptoms and Treatments of an Invisible Illness That Requires Specialized Attention

- AMASVISTA Glass: 10 reasons to choose SUNFLEX glass curtains

- Robotic Surgery, Immunotherapy and Comprehensive Care Take Centre Stage at Pancreatic Cancer Conference at Quirónsalud Torrevieja

- Robotic Surgery Against Ovarian Cancer: Greater Precision, Less Pain and Faster Recovery

Ctra. Cabo La Nao, CC La Nao, Local 6 03730 Javea, Alicante, Spain

Advertise with us

Do you have a business in Spain? Do you provide a service to the expat community in Spain? Would you like your message to reach over 500.000 people on a weekly basis?

BayRadio is a community orientated radio station offering fantastic content to our many listeners and followers across our various platforms. Contact us now and find out what Bay can do for you!

Our business is helping your business grow.

BAY RADIO S.L. © 2024. ALL RIGHTS RESERVED. WEB DESIGN BY MEDIANIC