-

play_arrow

play_arrow

BayRadio Listen Live Broadcasting in Spain

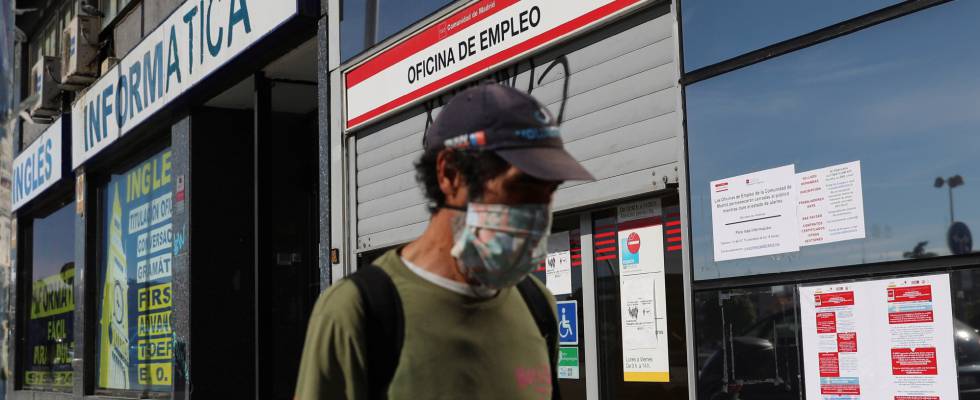

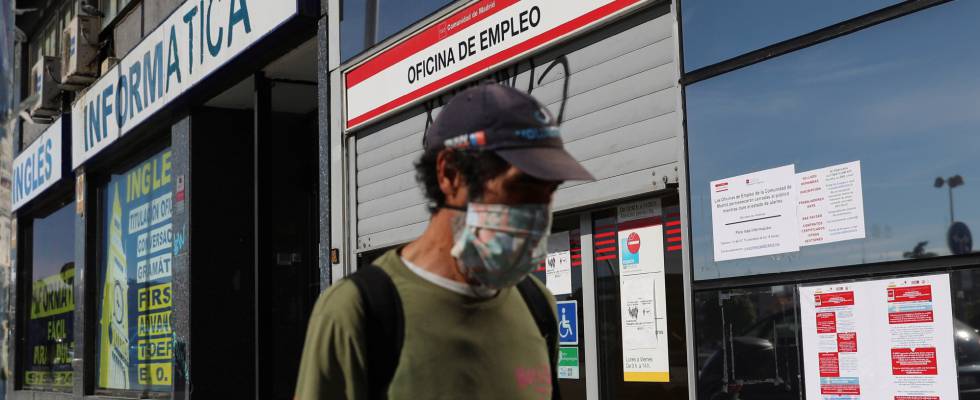

Rather than a fix monthly rate, freelancers will soon be able to pay social security based on how much they earn.

The government is moving towards a progressive tax system for those claiming autonomo in Spain. This has been a long standing campaign by some low income freelancers that have to pay a fixed rate of social security.

Under the current system, those on autonomo can choose which monthly social security tax they pay. The more expensive rate give more benefits down the line. However, 84% of those on autonomo chose to pay the lowest bracket.

This new system will mimic Spain’s current income tax framework. The Social Security Ministry and the Tax agency are pooling their data in order to facilitate the system.

Sources from the government departments have said that the importance of the new system is simplicity. Extra paperwork for those on autonomo will lead to confusion and failure of the plan.

Some are against the new system. Lorenzo Amor, president of the self-employed workers association ATA, thinks that now is a bad time to introduce new payment systems for a low income bracket. He believes that it might lead to higher monthly payments for some freelancers.

He said: “We will not support any change in the contribution system for the self-employed that means a raise in their contributions. This is not the right time, and the self-employed are really struggling.

Other self employment associations have welcomed the plan. José Landaburu, secretary general of UATAE said: “The current system is unfair, since those with lower incomes are harmed, as they have to make a contributive effort that is above their possibilities,”

Written by: BayRadio News

Similar posts

Recent Posts

- Robotic Surgery for Prostate Cancer: What Is Radical Prostatectomy and How Does the Da Vinci Robot Improve It

- What Is Fibromyalgia? Symptoms and Treatments of an Invisible Illness That Requires Specialized Attention

- AMASVISTA Glass: 10 reasons to choose SUNFLEX glass curtains

- Robotic Surgery, Immunotherapy and Comprehensive Care Take Centre Stage at Pancreatic Cancer Conference at Quirónsalud Torrevieja

- Robotic Surgery Against Ovarian Cancer: Greater Precision, Less Pain and Faster Recovery

Ctra. Cabo La Nao, CC La Nao, Local 6 03730 Javea, Alicante, Spain

Advertise with us

Do you have a business in Spain? Do you provide a service to the expat community in Spain? Would you like your message to reach over 500.000 people on a weekly basis?

BayRadio is a community orientated radio station offering fantastic content to our many listeners and followers across our various platforms. Contact us now and find out what Bay can do for you!

Our business is helping your business grow.

BAY RADIO S.L. © 2024. ALL RIGHTS RESERVED. WEB DESIGN BY MEDIANIC